oregon tax payment system

Pay what you can by the due date of the return. In order to make the.

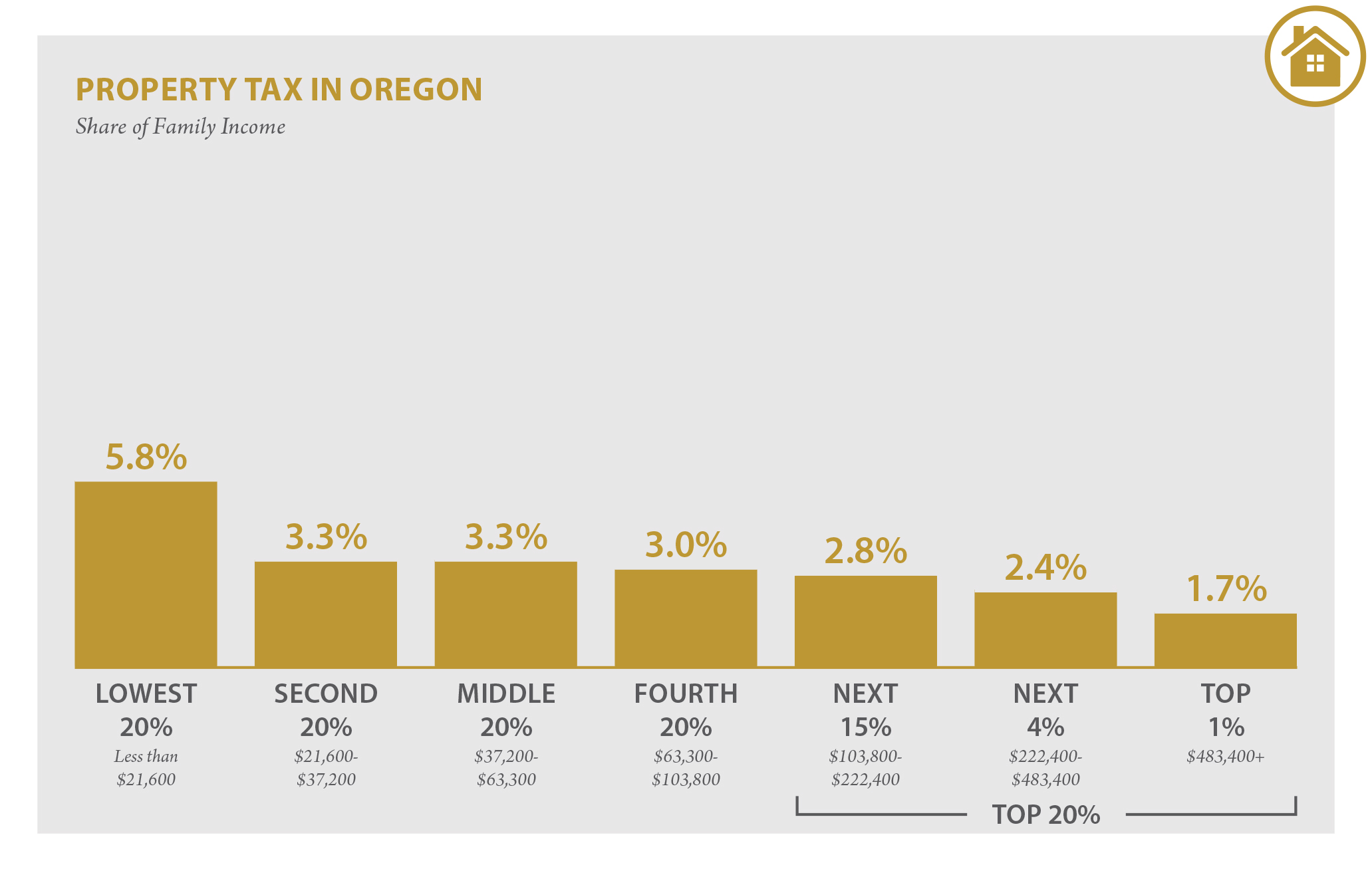

8 Things To Know About Oregon S Tax System Oregon Center For Public Policy

Mail a check or money order.

. Skip to the main content of. Your browser appears to have cookies disabled. The Oregon Tax Payment System uses the ACH debit method to make an Electronic Funds Transfer EFT to the state of Oregon for combined.

Corporate Income and Excise. These are the steps of the process. The Oregon Tax Payment System uses the ACH debit method to make an Electronic Funds Transfer EFT to the state of Oregon for combined payroll taxes or corporation.

To electronically pay state payroll taxes including the WBF assessment by electronic funds transfer EFT use the Oregon Department of Revenues self-service site Revenue Online. You have been successfully logged out. Once completed your federal and state returns are signed with a federal.

Electronic payment from your checking or savings account through the Oregon Tax Payment System. If you are a first time user of the. If you need to make any updates you.

Payment is coordinated through your financial institution and they may charge a fee for this service. Tax Payment System Welcome The Oregon Department of Revenue is no longer updating bank account information in the Oregon Tax Payment System. Instructions for personal income and business tax tax forms payment options and tax account look up.

You can use a tax preparer Oregon-approved software or a free e-filing service. 503-588-5215 propertytaxcomarionorus Marion County mails approximately 124000 property tax statements each year. The Oregon tax payment deadline for payments due with the 2019 tax year return is automatically extended to July 15 2020.

If you have any questions or problems with this system please call our EFT HelpMessage Line at 503-947-2017 or visit our EFT Questions and Answers. Beginning with the third quarter filing in 2022 Frances Online will replace the Oregon Payroll Reporting System OPRS and the Employer Account Access EAA portal. These are the taxes fees etc.

The Oregon Tax Payment System uses the ACH debit method to make an Electronic Funds Transfer EFT to the state of Oregon for combined payroll taxes or corporation excise and income taxes. Payments can be made using the Department of Revenues site Revenue Online httpsrevenueonlinedororegongovtap_. You may use this Web site and.

The statements are mailed between. EFT Questions and Answers. Paying Your Taxes Phone.

Payment arrangem ents We offer payment plans up to 36 months. Cookies are required to use this site. Tax Payment System Oregon Tax Payment System Oregon Department of Revenue EFT Questions and Answers Be advised that this payment application has been recently updated.

You must pay your Oregon combined payroll and corporate excise or income taxes through EFT if you are federally mandated to use the Electronic Federal Tax Payment System EFTPS. Submit your application by going to Revenue Online and clicking on Apply for ACH credit under Tools. That your company is being charged by Oregon for the current year and are based on the actual premiums written in Oregon by your company.

If you are already registered sign in to update your account file your tax reports andor pay any balance due. Be advised that this payment application has been recently updated. This EFTPS tax payment service Web site supports Microsoft Internet Explorer for Windows Google Chrome for Windows and Mozilla Firefox for Windows.

Oregon Tax Payment System. OPRS is a reporting system only. Call us at 503 945-8200 to discuss your debt and options.

Everything you need to file and pay your Oregon taxes. To set up a plan. Welcome to the Oregon Fuels Tax System.

It is not a payment system. You can make ACH debit payments through this system at any time with or. UI Payroll Taxes Regular unemployment insurance UI benefits are paid to eligible people who are unemployed or have had their hours reduced through no fault of their own.

Oregon Tax Payment System Oregon Department of Revenue. You may now close this window.

State Of Oregon Blue Book Government Finance State Government

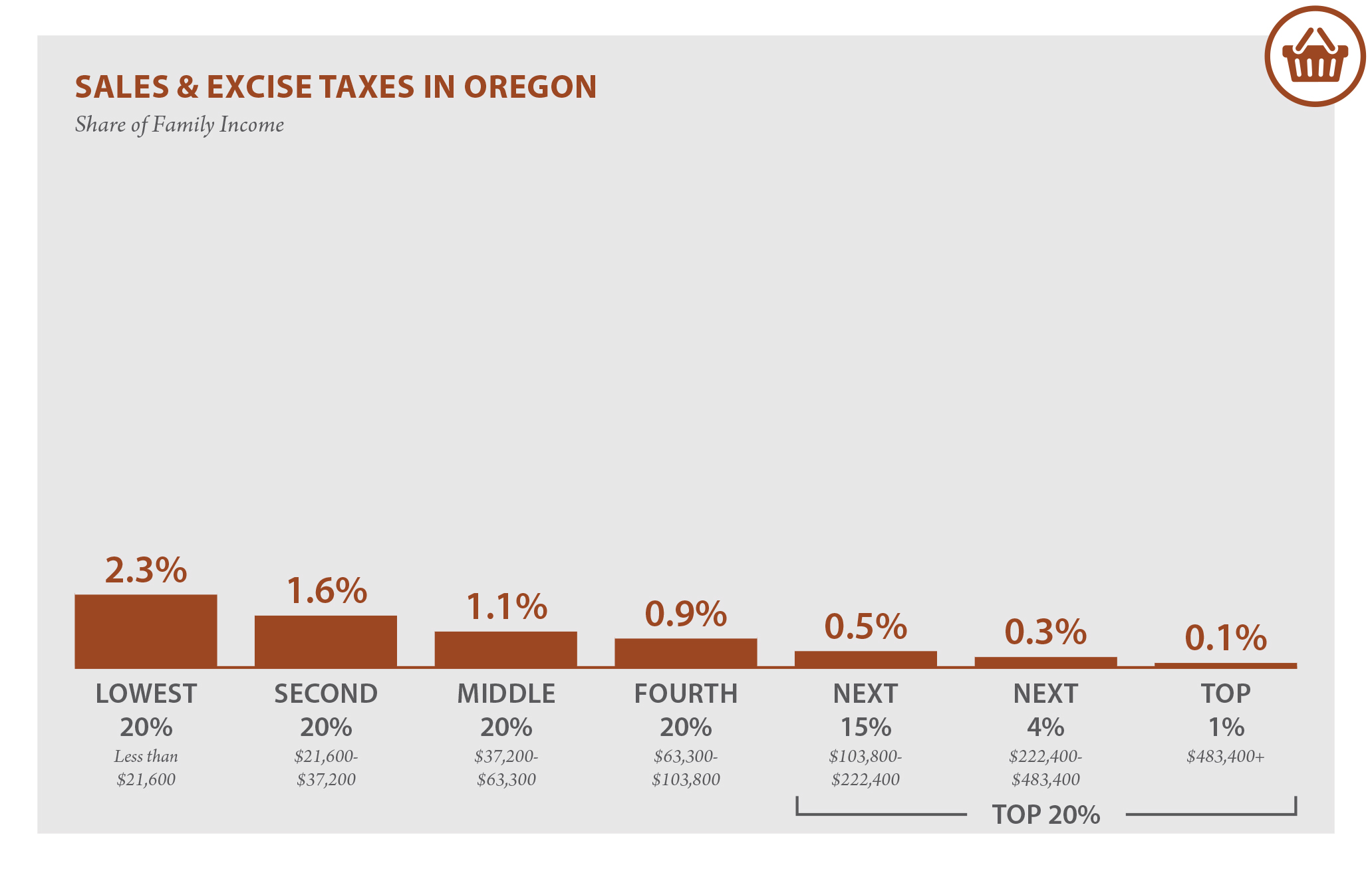

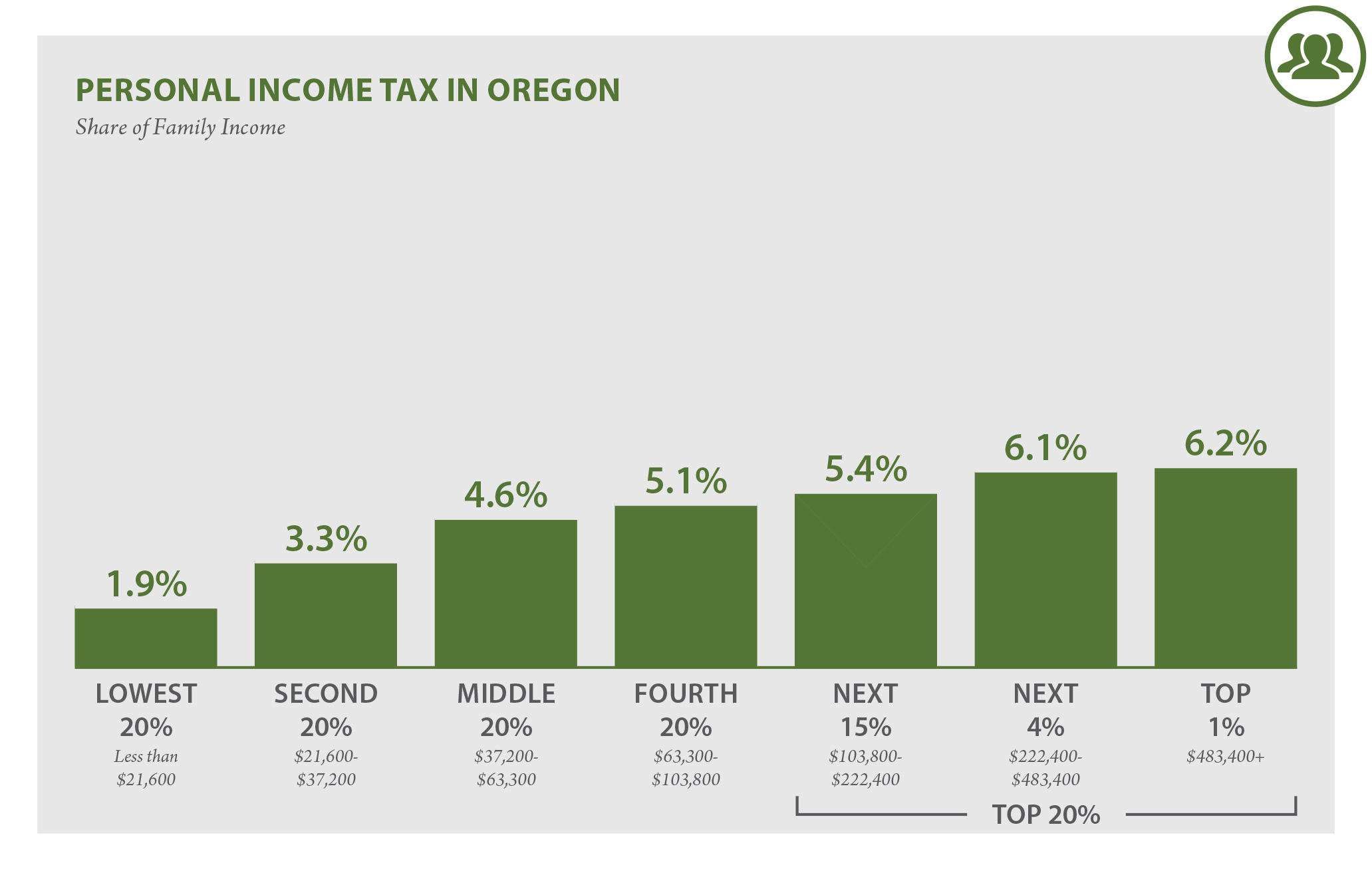

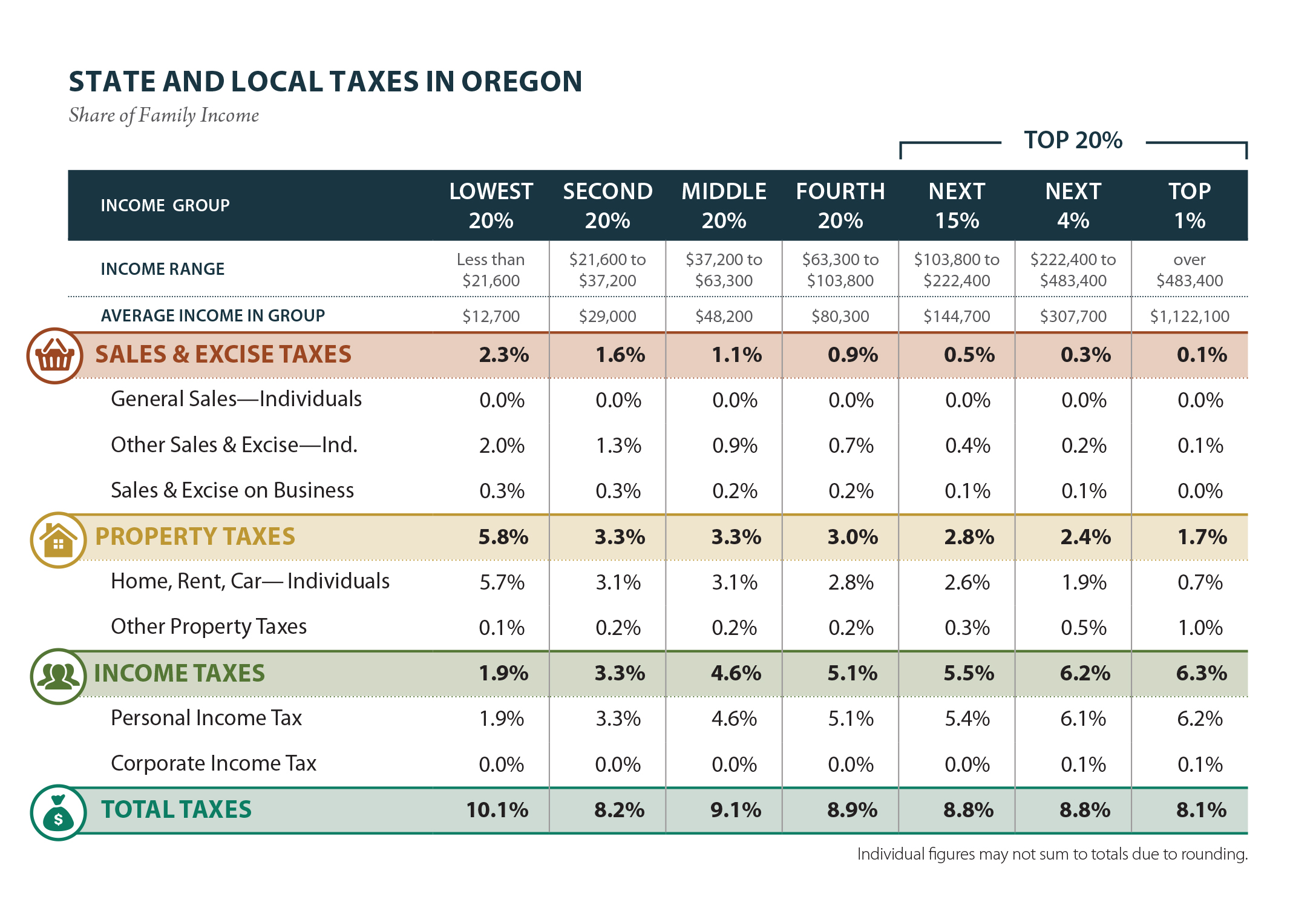

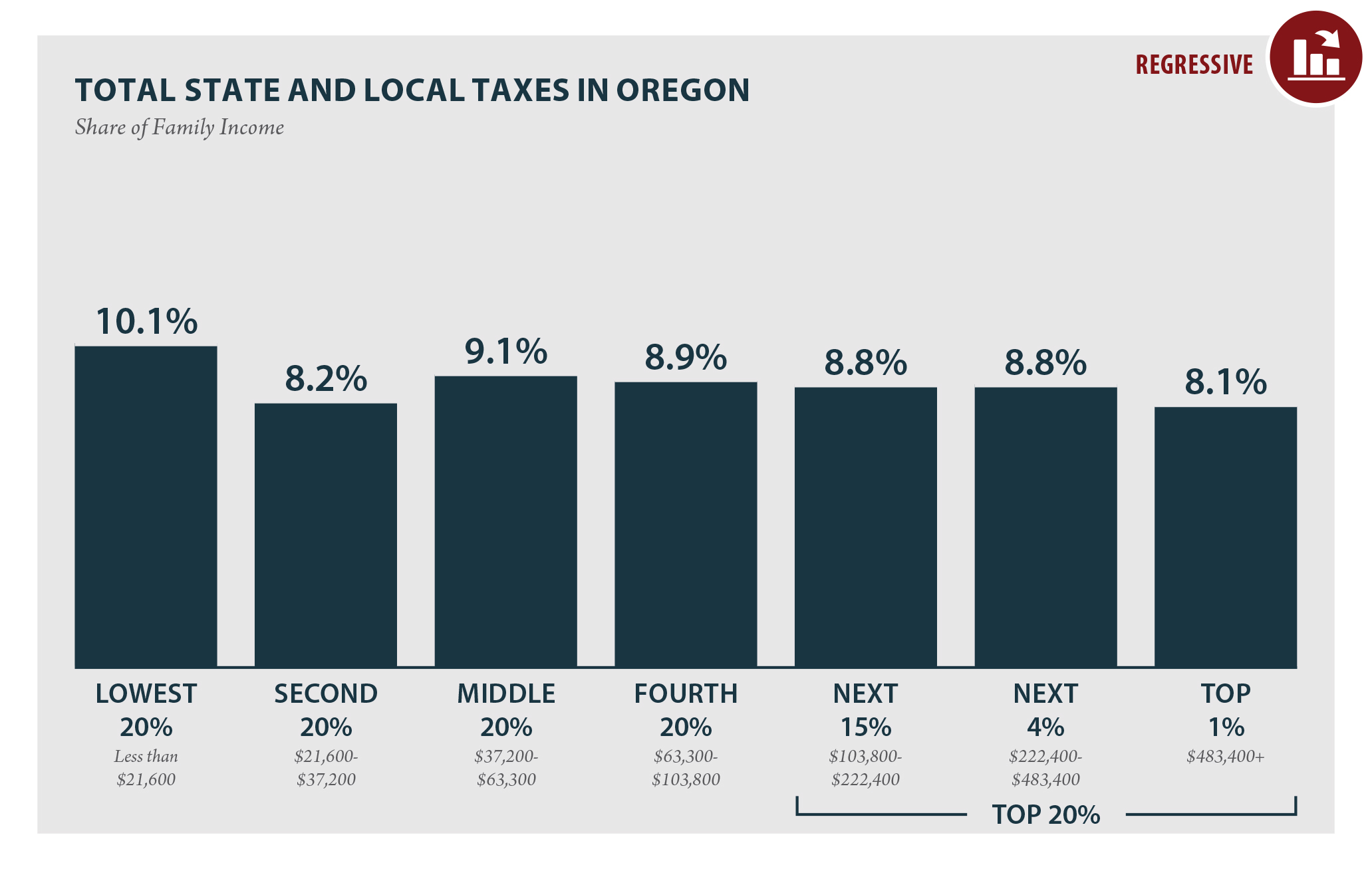

Oregon Who Pays 6th Edition Itep

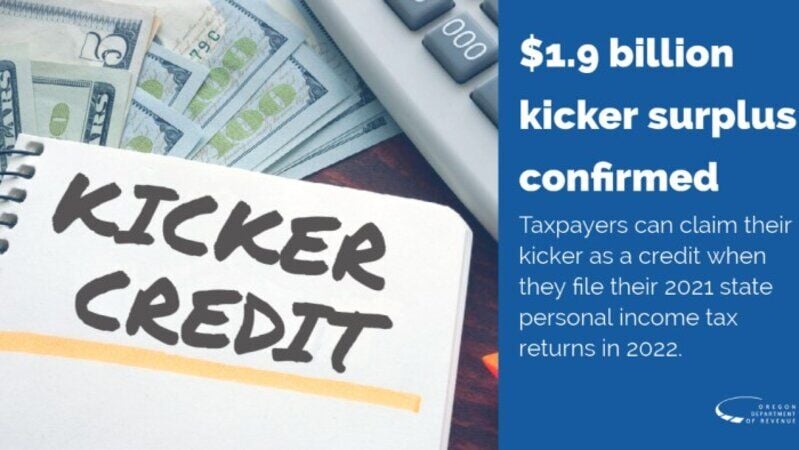

Oregon Taxpayers Will Receive Kicker Rebate On 2021 Tax Returns Thanks To 1 9 Billion Surplus Local Kdrv Com

Oregon Who Pays 6th Edition Itep

8 Things To Know About Oregon S Tax System Oregon Center For Public Policy

Oregon Who Pays 6th Edition Itep

Assessor Malheur County Oregon

Oregon Who Pays 6th Edition Itep

Pass Through Income Tax Loophole Favors The Well Off While Disadvantaging Workers Oregon Center For Public Policy

Oregon Who Pays 6th Edition Itep

State Of Oregon Oregon Department Of Revenue Payments

Oregon Taxpayers Will Receive Kicker Rebate On 2021 Tax Returns Thanks To 1 9 Billion Surplus Local Kdrv Com

8 Things To Know About Oregon S Tax System Oregon Center For Public Policy

An Oregon Highway Use Tax Bond Is Required Of All Newly Registered Motor Carriers Oregon Surety Bond Leader Surety One Inc Offe Oregon Underwriting Highway

Oregon Judicial Department Tax Court Opinions Tax Court Opinions State Of Oregon

State Of Oregon Blue Book Government Finance Taxes