capital gains tax proposal canada

A federal NDP campaign promise to increase the capital gains inclusion rate to 75 from 50 would bring in 447 billion over the next five years according to estimates released by the Parliamentary Budget Office. The main proposals include.

Challenging Books In Library Study To Rise In 2021 In 2022 Books History Lessons Education Reform

The cost of the asset and typically the cost of selling it is excluded from the tax.

. Use Schedule 3 Capital gains or losses to calculate and report all your capital gains and losses. When it comes to capital gains tax in the provinces capital gains is calculated the exact same way as it is federally with 50 of the capital gain being taxed according to your marginal tax rate. A capital gains tax increase would be a form of annual wealth tax that would be.

A Capital Gains Tax On Real Estate. NDPs proto-platform calls for levying. The effective capital gains tax rate in Canada is 50 of your marginal tax rate.

Canada is one of the few countries that doesnt have a capital gains tax on a households primary residence. The capital gains tax rate in Canada can be calculated by adding the income tax rate in each province with the federal income tax rate and then multiplying by the 50 capital gains inclusion rate. Drafter123 iStockphoto.

The party released the PBOs costing of its campaign platform on Saturday. In Canada capital gains tax is applied to 50 of the profit you made. The long-term capital gains rate would be increased to 25 for transactions taking place on or after Monday September 13 2021.

The top marginal income tax rate for individuals trusts and estates would be increased to 396. The news release that accompanied the Proposals. The tax is usually applied to profit made on the sale of assets.

Because only 12 of the capital gain is taxable Mario completes section 3 of Schedule 3 and reports 1220 as his taxable capital gain at line 12700 on his income tax and benefit return. And the tax rate depends on your income. Capital gains are profits made from the sale of an investment like a stock or bond.

The gains on your stocks. Do not include any capital gains or losses in your business or property income even if you used the property for your business. What is the Tax Rate on Capital Gains in Canada.

Feb 7 2022. Changes to Tax Rates. At the current 50 percent inclusion rate for capital gains the rate on capital gains is approximately 115-13 percent for corporations plus 1023 percent refundable tax for Canadian-controlled private corporations and 24-27 percent for individuals at the highest marginal rate depending on the province.

The Proposals include amendments to both the Income Tax Act ITA and the Excise Tax Act ETA. The Ways and Means Proposal would increase the top marginal corporate income tax rate to 265. For a Canadian earning 75000 per year with a marginal tax rate of 30 any capital gain they received would be taxed at 15.

Note thats profit not the selling price. For a Canadian who falls in a 33 marginal tax bracket the income earned from the capital gain of 25000 results in 8250 in taxes owing. For more information see Completing Schedule 3.

To eliminate tax avoidance opportunities the inclusion rate should also rise to 80 per cent for capital gains realized by corporations which would raise the revenue impact to an estimated 190 billion annually or 57 per cent of all federal and provincial income tax revenues. Increasing the top capital gains rate for people with an annual income of more than US1-million to 396 per cent from 20 per cent. On February 4 2022 the federal government released a package of draft legislation to implement various tax measures Proposals including some previously announced in the 2021 Federal Budget.

This is equivalent to 50 of your capital gain multiplied by your full marginal tax rate. If you donated certain properties to a qualified donee you will also have to complete Form T1170 Capital. 6500 - 4000 60 2440.

Your income tax rate bracket is determined by your net income which is your gross income less any contributions to registered investment accounts. None of the plans put forward by Canadas main parties suggest lifting the capital gains exemption for principal residences with the exception of. The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75.

U S Estate Tax For Canadians Manulife Investment Management

Irs Tax Forms Form 1040 Schedule C Schedule E And K 1 For Business Irs Tax Forms Irs Taxes Tax Forms

Black Pen On W8ben Tax Form Stock Photo 786362671 Shutterstock

Pin By Oksana On Business Business Investors Schedule How To Plan

Look Ventilator Hack From Canada Genius Doctor Transforms 1 Ventilator To 9 Healthcare Channel Hospital Technology Updates Turn Ons

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

Apecoin Community Votes On Keeping Ape Token In The Ethereum Ecosystem Altcoins Bitcoin News

Retailers Fiscal Future Laws Regulations Content From Supermarket News The American Taxpayer Relief Act Flow Chart Data Visualization Infographic Fiscal

Company Mission Statement Examples Income Statement Company Mission Statement Examples Statement Template

House Democrats Tax On Corporate Income Third Highest In Oecd

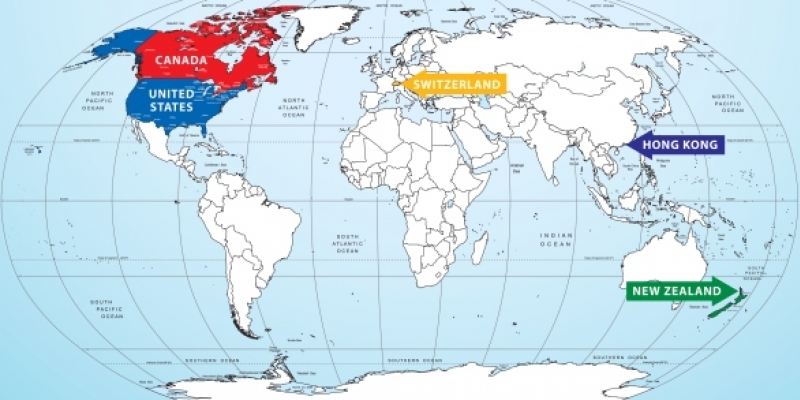

Capital Gains Tax Reform In Canada Lessons From Abroad Fraser Institute

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Retailers Fiscal Future Laws Regulations Content From Supermarket News The American Taxpayer Relief Act Flow Chart Data Visualization Infographic Fiscal

The Looming Capital Gains Tax Hike The Potential Impact On Businesses And Individuals Sc H Group